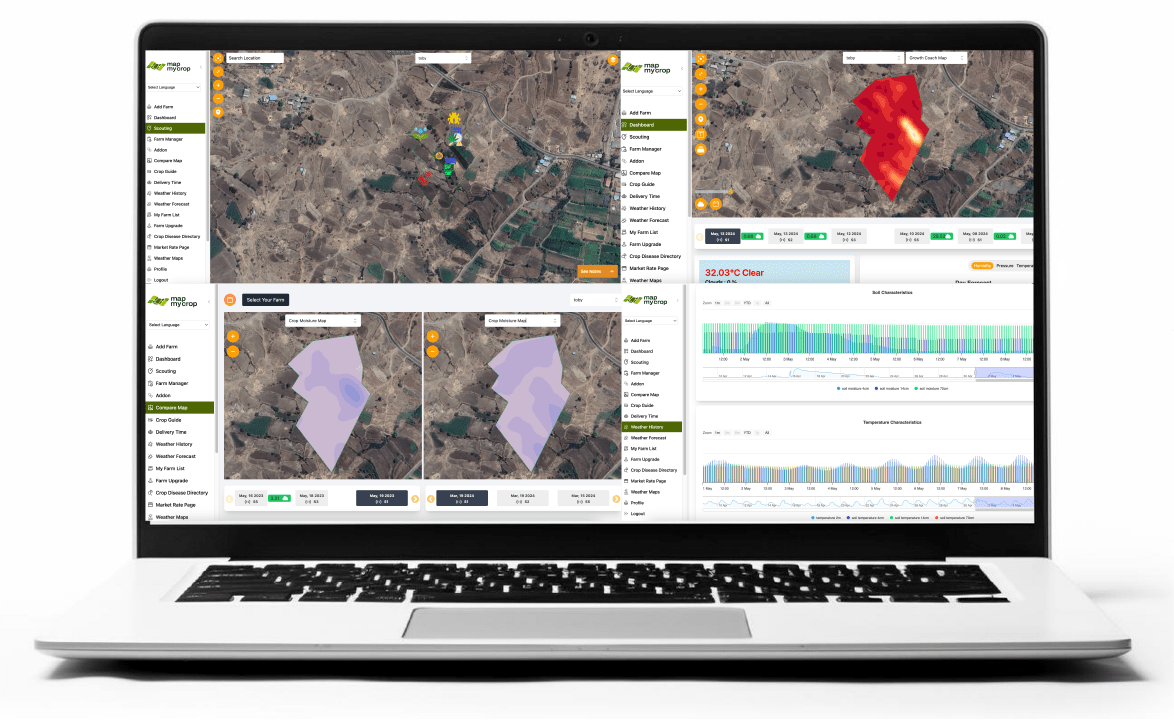

Risk Monitoring

Knowing the risks, avoiding portfolio over-exposures to certain climatic hazards or just setting appropriate rates in both high and low risk zones can be a key competitive advantage for crop insurers.

Based on historical weather and satellite data going back five decades, We developed a new Agro analytics platform. Insured portfolios can easily be uploaded to the platform and a risk score for selected climatic hazards is calculated. The platform allows underwriters to better select risks and steer their agro portfolio. On a detailed scale, risk zones are identified for different perils and the frequency and severity of abnormal climate events are automatically calculated.